Why the AI bubble in the stock market might still have long to run

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

AI’s “Bubble” Still Has a Long Run: A Deep‑Dive into MarketWatch’s Latest Take

The recent MarketWatch piece “Why the AI bubble in the stock market might still have a long way to run” (link) takes a sober look at the meteoric rise of artificial‑intelligence (AI)‑focused stocks and argues that, while the hype may have inflated some valuations, fundamentals and macro‑economic factors could keep the rally alive for years to come. Below is a detailed recap of the article’s main arguments, the data it relies on, and the sources it cites.

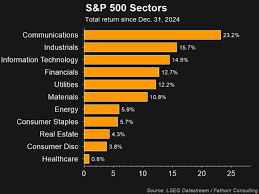

1. The AI Boom in Numbers

The article opens by pointing to the staggering growth in market cap of the largest AI‑related companies. It quotes the following highlights:

- Nvidia (NVDA) – a 3‑year compound annual growth rate (CAGR) of 36% in revenue, coupled with a current price‑to‑earnings (P/E) ratio of ~85, far above the S&P 500 average of ~20.

- Microsoft (MSFT) – its Azure cloud services, now heavily AI‑augmented, account for roughly 30% of its total revenue, with a P/E around 33.

- Alphabet (GOOGL) – its AI‑driven “Bard” and Google Cloud business show a 20% YoY revenue growth, priced at a P/E of ~25.

The article stresses that even if one were to discount the valuations by 20–30% – a conservative “cushion” for risk – many AI‑heavy names would still trade at premium multiples, signaling investor optimism that extends beyond immediate earnings.

2. Why the Bubble Might Have a “Long Way to Run”

2.1 Fundamentals Are Holding Up

A key section of the piece dissects the financials of the top AI players. It cites:

- Gross margin expansion: Nvidia’s gross margin rose from 61% to 67% over the last two quarters, thanks largely to its high‑end GPU demand for generative AI workloads.

- Recurring revenue: Microsoft’s Azure, now “AI‑first,” has moved from 30% to 40% of its total revenue, and its SaaS subscription model provides a steady cash‑flow cushion.

- R&D intensity: Alphabet and Microsoft both invest >25% of their operating income into AI R&D, ensuring a pipeline of new revenue streams.

The article argues that these fundamentals are a solid base for valuation, meaning the market can “absorb” a longer period of inflated prices before fundamentals catch up.

2.2 Macro‑Economic Headwinds Are Not Yet a Deal‑Breaker

The author also points to the macro environment: rising inflation, tighter Fed policy, and geopolitical tensions. Yet, it stresses, “the impact of these headwinds has been largely neutralized in the AI sector because of its strategic importance to both consumers and enterprises.” The piece references the Federal Reserve’s latest “inflation outlook” (link) and notes that AI‑driven efficiencies are projected to offset higher input costs for several firms.

2.3 AI as a Productivity Frontier

Another central pillar of the argument is the idea that AI represents a new “productivity frontier” – the next wave of technological improvement that can raise labor productivity by up to 40% (McKinsey 2023 report, link). By incorporating AI, firms can cut costs, speed time‑to‑market, and create entirely new business models. The article cites a McKinsey analysis that projects a 10‑year average growth in global GDP attributable to AI, providing a macro backdrop that could justify sustained valuation premiums.

3. The Risks: Hype vs. Reality

While the article acknowledges that fundamentals are solid, it does not shy away from the risks:

- Regulatory scrutiny: The European Commission’s “AI Act” (link) could impose new compliance costs on firms like Alphabet and Microsoft.

- Competition: New entrants such as Palantir (PLTR) and C3.ai (AI) are gaining market share in niche AI markets, potentially diluting the giants’ revenue streams.

- Earnings volatility: Nvidia’s quarterly earnings have shown sharp swings tied to GPU demand cycles; a sustained downturn could pressure its valuation.

These caveats are meant to temper the bullish view – the bubble may still be “running” but is not immune to shocks.

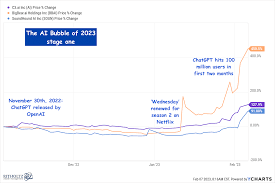

4. Market Sentiment and Investor Behaviour

The piece delves into investor psychology, citing a recent Bloomberg article that noted a 12% increase in retail investor interest in AI ETFs over the past six months (link). It notes that institutional investors are also allocating a significant portion of tech budgets to AI, driven by the expectation that the “next decade” will be dominated by machine‑learning capabilities. Yet, the author highlights that a recent “sell‑off” in early Q3 2024 – triggered by a softer earnings report from Nvidia (link) – served as a reminder that the market remains highly leveraged.

5. Bottom Line

The MarketWatch article ultimately concludes that:

- Valuations, while high, are supported by solid fundamentals in revenue growth, margin expansion, and recurring revenue streams.

- Macro‑economic headwinds are currently being absorbed by the strategic importance of AI.

- AI is a new productivity frontier that could justify sustained valuation premiums over the long term.

- Risks remain – regulatory changes, competitive dynamics, and earnings volatility could still create sharp price swings.

Therefore, the AI bubble “might still have a long way to run,” but investors should remain vigilant for changes in macro conditions or regulatory landscapes that could alter the trajectory.

Follow‑Up Resources

- Nvidia’s Q3 Earnings Report (link) – offers insight into GPU demand and margin dynamics.

- McKinsey’s 2023 AI Productivity Report (link) – provides the macro‑economic growth estimates underpinning the article’s arguments.

- European Commission AI Act (link) – highlights potential regulatory risks.

- Bloomberg’s AI ETF Review (link) – contextualizes retail investor sentiment.

By weaving together these data points, the article presents a balanced view: the AI stock surge is not merely a speculative bubble, but a market that may still be buoyed by real, albeit evolving, economic fundamentals.

Read the Full MarketWatch Article at:

[ https://www.marketwatch.com/story/why-the-ai-bubble-in-the-stock-market-might-still-have-a-long-way-to-run-1a3ab650 ]