Americas Car Mart (CRMT) Up After BUYINS.NET Report Predicted Strength After Earnings

November 20, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, a provider of unique trading technologies, released a report on November 18, 2009 at 6:42 am PST stating that Americas Car Mart (NASDAQ: CRMT) was expected to be higher after its earnings were released before the open on Friday, November 20, 2009. Click here to view the BUYINS.NET report: http://www.buyins.net/releases/?id=65139

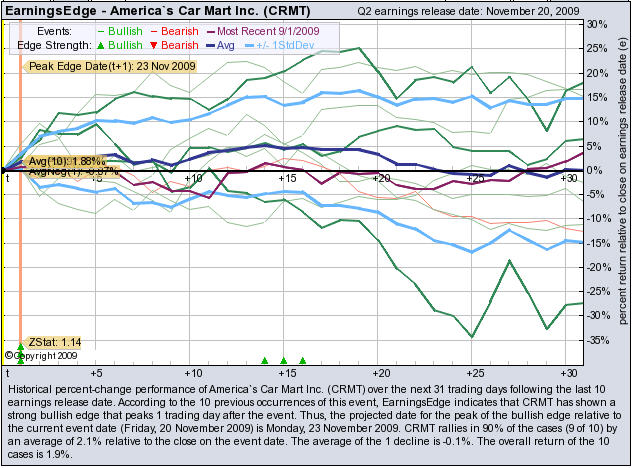

According to the 10 previous quarterly earnings reports, CRMT has shown a bullish edge that peaks 1 trading day after the report. CRMT rallies in 90% of the cases (9 of 10) by an average of +2.1% relative to the date of the earnings release. At the time this story was written, CRMT is +3.98% after earnings were released.

Click here to see a chart showing trading patterns after the previous earnings reports:

The movement of stock prices in the days and weeks leading to and following earnings announcements may follow a predictable pattern. Most companiesa� stock price histories show random or unpredictable movements around earnings dates. But some seem to repeat the same pattern quarter after quarter, year after year. The specific technology used to make these predictions is available for a low monthly fee at http://www.squeezetrigger.com/services/strat/mh.php

About BUYINS.NET

BUYINS.NET, www.buyins.net, monitors trading in all US stocks in real time and maintains massive databases of short sale and naked short sale time and sales data, short squeeze SqueezeTrigger prices, market maker price movements, shareholder data, statistical data on earnings, sector correlation, seasonality, hedge fund trading strategies, comparable valuations. Reports include:

REGULATORY & COMPLIANCE NEWS

Friction Factor -- market maker surveillance system tracking Level II market makers in all stocks to determine Price Friction and compliance with new "Fair Market Making Requirements"

RegSHO Naked Shorts -- tracks EVERY failure to deliver in all US stocks and tracks all Threshold Security Lists daily for which stocks have naked shorts that are not in compliance with Regulation SHO

INVESTMENTS & TRADING

SqueezeTrigger -- 25 billion cell database tracks EVERY short sale (not just total short interest) in all US stocks and calculates volume weighted price that a short squeeze will begin in each stock.

Earnings Edge -- predicts probability, price move and length of move before and after all US stock earnings reports.

Seasonality -- predicts probability, price move and length of move based on exact time of year for all US stocks.

Group Trader -- tracks sector rotation and stock correlation to its sector and predicts future moves in ALL sectors and industry groups.

Pattern Scan -- automates tracking of every technical pattern and predicts time and size of move in all stocks.

GATS (Global Automated Trading System) -- tracks all known trading strategies and qualifies and quantifies which are working best in real time.

DISCLAIMER: BUYINS.NET is not a registered investment advisor and nothing contained in any materials should be construed as a recommendation to buy or sell any securities. BUYINS.NET has not been compensated by any of the above mentioned companies. Past performance is not indicative of future results. Please visit our web site, www.buyins.net, for complete risks and disclosures.

Contact:

BUYINS.NET Thomas Ronk 800-715-9999 tom@buyins.net www.buyins.net