DRYS, ARM, EGLE, SPPI, CENX, AMKR. Top Losing Stocks With Negative Price Friction In Morning Trade Today

July 13, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, announced today its proprietary Market Maker Friction Factor Report for July 13, 2009. Since late October market makers are now required to be on the bid as much as they are on the offer and for like amounts of stock. This afair market makinga requirement is designed to prevent market makers from manipulating stock prices. Here is a list of the top companies with the largest losses this morning and negative price friction (bearish). This means that there was more selling than buying in the stocks and their stock prices dropped faster with less Friction. DryShips (NASDAQ: DRYS), ArvinMeritor (NYSE: ARM), Eagle Bulk Shipping (NASDAQ: EGLE), Spectrum Pharmaceuticals (NASDAQ: SPPI), Century Aluminum (NASDAQ: CENX) and Amkor Technology (NASDAQ: AMKR). To access Friction Factor, Naked Short Data and SqueezeTrigger Prices on all stocks please visit http://www.buyins.net .

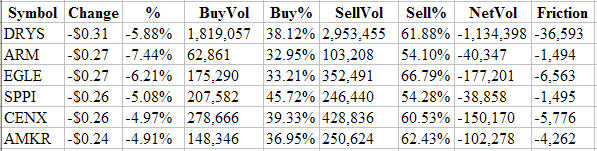

Market Maker Friction Factor is shown in the chart below:

Symbol Change % BuyVol Buy% SellVol Sell% NetVol Friction

DRYS -$0.31 -5.88% 1,819,057 38.12% 2,953,455 61.88% -1,134,398 -36,593

ARM -$0.27 -7.44% 62,861 32.95% 103,208 54.10% -40,347 -1,494

EGLE -$0.27 -6.21% 175,290 33.21% 352,491 66.79% -177,201 -6,563

SPPI -$0.26 -5.08% 207,582 45.72% 246,440 54.28% -38,858 -1,495

CENX -$0.26 -4.97% 278,666 39.33% 428,836 60.53% -150,170 -5,776

AMKR -$0.24 -4.91% 148,346 36.95% 250,624 62.43% -102,278 -4,262

Click here to view chart:

Analysis of the Friction Factor chart above shows that each of the six stocks mentioned above have high net dollar losses (Change) and extremely low price friction in their stocks. The Friction Factor displays how many more shares of buying than selling are required to move a stock higher by one cent or how many more shares of selling than buying moves a stock lower by 1 cent.

For example, the chart above shows DRYS with a dollar loss this morning of -$0.31 and a Friction Factor of -36,593 shares. That means that it only takes 36,593 more shares of selling than buying to move DRYS lower by one penny. This means the Market Makers are allowing the stock to drop quickly (low friction). The combination of low friction and negative market direction can drive prices lower faster than normal.

DryShips Inc. (NASDAQ: DRYS) engages in the ownership and operation of drybulk carriers worldwide. Its fleet carries various drybulk commodities, including coal, iron ore, grains, bauxite, phosphate, fertilizers, and steel products. As of March 26, 2009, the company owned and operated a fleet of 40 drybulk carriers comprising 7 Capesize, 29 Panamax, 2 Supramax, and 2 newbuilding drybulk vessels, which have a combined deadweight tonnage of approximately 3.3 million. It also owned and operated two ultra-deep water semi-submersible drilling rigs and two ultra deep-water newbuilding drillships. The company was founded in 2004 and is based in Athens, Greece.

ArvinMeritor, Inc. (NYSE: ARM) supplies a range of integrated systems, modules, and components to commercial truck, light vehicle, trailer, and specialty original equipment manufacturers, as well as various after markets worldwide. The companya�s products include commercial vehicle systems comprising truck axles, drivelines and other products, suspension systems and trailer products, braking systems, and transmissions; and specialty systems consisting of off-highway vehicle products, specialty vehicle products, and government products, such as axles, brakes, and brake system components, including ABS, trailer products, transfer cases, and drivelines for use in medium-duty and heavy-duty military tactical wheeled vehicles. It also offers light vehicle systems that comprise body systems, such as roof systems and door systems; chassis systems consisting of suspension systems, suspension modules, ride control products, and wheel products, such as fabricated steel wheels, bead seat attached wheels, full-face designed wheels, and clad wheels. The company primarily has joint ventures with Mitsubishi Steel Manufacturing Co. and Randon S. A. ArvinMeritor, Inc. was founded in 1921 and is headquartered in Troy, Michigan.

Eagle Bulk Shipping Inc. (NASDAQ: EGLE) engages in the ocean transportation of bulk cargoes in the dry bulk industry. The company transports primarily iron ore, coal, grain, cement, and fertilizer along worldwide shipping routes. As of December 31, 2008, it owned and operated a fleet of 23 oceangoing vessels with a combined carrying capacity of 1,184,939 deadweight tons. The company was founded in 2005 and is headquartered in New York, New York.

Spectrum Pharmaceuticals, Inc. (NASDAQ: SPPI), a commercial-stage biotechnology company with a focus on oncology, develops and commercializes a portfolio of drug products. Its marketed products include ZEVALIN, a form of cancer therapy called radioimmunotherapy for the treatment of non-Hodgkin's Lymphoma (NHL); and FUSILEV, which is indicated after high-dose methotrexate therapy in patients with osteosarcoma. The company is also developing apaziquone for the treatment of non-muscle invasive bladder cancer. Its phase II products include Ozarelix, a drug being investigated for benign prostatic hypertrophy (BPH), a non-cancerous enlargement of the prostate, and hormone dependent prostate cancer; and Ortataxel, a third-generation taxane. The company was formerly known as NeoTherapeutics, Inc. and changed its name to Spectrum Pharmaceuticals, Inc. in December 2002. Spectrum Pharmaceuticals, Inc. was founded in 1987 and is based in Irvine, California.

Century Aluminum Company (NASDAQ: CENX), through its subsidiaries, produces primary aluminum in the United States and internationally. The company offers molten aluminum, as well as standard-grade ingot, extrusion billet, and other value-added primary aluminum products. It also holds 50 percent joint venture interests in the Gramercy alumina refinery, located in Gramercy, Louisiana and a related bauxite mining operation in Jamaica. The company was founded in 1981 and is based in Monterey, California.

Amkor Technology, Inc. (NASDAQ: AMKR) operates as a subcontractor of semiconductor packaging and test services in the United States and internationally. It provides packaging solutions, including leadframe and laminate packages using wire bond and flip chip formats. The company offers flip chip and wafer level packages in which the semiconductor die is connected directly to the package substrate or system board; three dimensional (3D) package-on-package and stacked chip scale packages in which the individual chips or individual packages are stacked vertically to provide integration of logic and memory; advanced leadframe packages, which are thinner and smaller packages; multi-chip or system-in-package modules used in mobile phones and other handheld end-products; and packages for micro-electromechanical system devices that are used in automotive, industrial, and consumer electronics markets. It also provides a line of advanced probe and final test services for analog, digital, logic, mixed signal, and radio frequency semiconductor devices. The company was founded in 1968 and is headquartered in Chandler, Arizona.

About BUYINS.NET

WWW.BUYINS.NET is a service designed to help bonafide shareholders of publicly traded US companies fight naked short selling. Naked short selling is the illegal act of short selling a stock when no affirmative determination has been made to locate shares of the stock to hypothecate in connection with the short sale. Buyins.net has built a proprietary database that uses Threshold list feeds from NASDAQ, AMEX and NYSE to generate detailed and useful information to combat the naked short selling problem. For the first time, actual trade by trade data is available to the public that shows the attempted size, actual size, price and average value of short sales in stocks that have been shorted and naked shorted. This information is valuable in determining the precise point at which short sellers go out-of-the-money and start losing on their short and naked short trades.

BUYINS.NET has built a massive database that collects, analyzes and publishes a proprietary SqueezeTrigger for each stock that has been shorted. The SqueezeTrigger database of nearly 2,550,000,000 short sale transactions goes back to January 1, 2005 and calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like Buyins.net to access the data.

The SqueezeTrigger database collects individual short trade data on over 7,000 NYSE, AMEX and NASDAQ stocks and general short trade data on nearly 8,000 OTCBB and PINKSHEET stocks. Each month the database grows by approximately 50,000,000 short sale transactions and provides investors with the knowledge necessary to time when to buy and sell stocks with outstanding short positions. By tracking the size and price of each montha�s short transactions, BUYINS.NET provides institutions, traders, analysts, journalists and individual investors the exact price point where short sellers start losing money and a short squeeze can begin.

All material herein was prepared by BUYINS.NET, based upon information believed to be reliable. The information contained herein is not guaranteed by BUYINS.NET to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. None of the companies in this report have paid to be included in this report. From time to time we will mention a company that may have previously paid $995 per month for market data purchased from BUYINS.NET. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. BUYINS.NET is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. BUYINS.NET will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

BUYINS.NET, FRICTION FACTOR and SQUEEZETRIGGER are intended for use by stock market professionals. As a member, visitor, or user of any kind, you accept full responsibilities for your investment and trading actions. The contents of BUYINS.NET, including but not limited to all implied or expressed views, opinions, teachings, data, graphs, opinions, or otherwise are not predictions, warranty, or endorsements of any kind. Please seek stock market advice from the proper securities professional, or investment advisor.

By visiting BUYINS.NET or using any data or services, you agree to assume full responsibility for the decisions or actions that you undertake. BUYINS.NET, LLC, its owner(s), operators, employees, partners, affiliates, advertisers, information providers and any other associated person or entity, shall under no circumstances be held liable to the user and/or any third party for loss or damages of any kind, including but not limited to trading losses, lost trading opportunity, direct, indirect, consequential, special, incidental, or punitive damages. As a user, you agree that any damages collected shall not exceed the amount paid to BUYINS.NET and/or its owners. As a website user, you agree that any and all legal matters of any kind are to be reviewed and handled in their entirety within the State of California only. By using the services of this website, you are consenting to the terms as outlined, and forfeit all legal jurisdictions in any other State. Past performance is not a guarantee of future outcomes. Any and all examples are hypothetical and should not be considered a guarantee or endorsement of such trading activity. BUYINS.NET does not take responsibility for problems of any kind, including but not limited to issues with operations, data accuracy or completeness, contacting issues, technical issues, and timeliness. BUYINS.NET places great integrity on the data collected and distributed. This information is deemed reliable, but not guaranteed. All information and data is provided "as is" without warranty or guarantee of any kind.

Please seek investment and/or trading advice, council, information or services from a securities professional. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and BUYINS.NET undertakes no obligation to update such statements.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the SEC.

Contact: Thomas Ronk, CEO www.BUYINS.net +1-800-715-9999 Tom@buyins.net