IRBT, GGN, NVGN, MDCO, SKS, RBY. Top Losing Stocks With Negative Price Friction In Morning Trade Today

July 9, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, announced today its proprietary Market Maker Friction Factor Report for July 9, 2009. Since late October market makers are now required to be on the bid as much as they are on the offer and for like amounts of stock. This afair market makinga requirement is designed to prevent market makers from manipulating stock prices. Here is a list of the top companies with the largest losses this morning and negative price friction (bearish). This means that there was more selling than buying in the stocks and their stock prices dropped faster with less Friction. iRobot (NASDAQ: IRBT), Gabelli Global Gold (AMEX: GGN), Novogen Ltd (NASDAQ: NVGN), Medicines Co. (NASDAQ: MDCO), Saks Inc. (NYSE: SKS) and Rubicon Minerals (AMEX: RBY). To access Friction Factor, Naked Short Data and SqueezeTrigger Prices on all stocks please visit http://www.buyins.net .

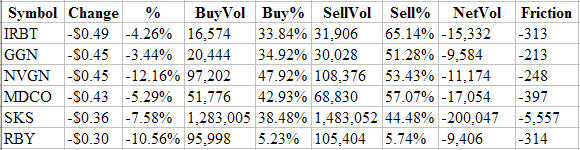

Market Maker Friction Factor is shown in the chart below:

Symbol Change % BuyVol Buy% SellVol Sell% NetVol Friction

IRBT -$0.49 -4.26% 16,574 33.84% 31,906 65.14% -15,332 -313

GGN -$0.45 -3.44% 20,444 34.92% 30,028 51.28% -9,584 -213

NVGN -$0.45 -12.16% 97,202 47.92% 108,376 53.43% -11,174 -248

MDCO -$0.43 -5.29% 51,776 42.93% 68,830 57.07% -17,054 -397

SKS -$0.36 -7.58% 1,283,005 38.48% 1,483,052 44.48% -200,047 -5,557

RBY -$0.30 -10.56% 95,998 5.23% 105,404 5.74% -9,406 -314

Click here to view chart:

Analysis of the Friction Factor chart above shows that each of the six stocks mentioned above have high net dollar losses (Change) and extremely low price friction in their stocks. The Friction Factor displays how many more shares of buying than selling are required to move a stock higher by one cent or how many more shares of selling than buying moves a stock lower by 1 cent.

For example, the chart above shows IRBT with a dollar loss this morning of -$0.49 and a Friction Factor of -313 shares. That means that it only takes 313 more shares of selling than buying to move IRBT lower by one penny. This means the Market Makers are allowing the stock to drop quickly (low friction). The combination of low friction and negative market direction can drive prices lower faster than normal.

iRobot Corporation (NASDAQ: IRBT) designs, develops, and markets robots to consumer, government, and industrial markets in the United States and internationally. The company offers consumer products, such as floor vacuuming robots, floor washing robots, gutter cleaning robots, pool cleaning robots, and programmable robots. Its government and industrial products include PackBot and PackBot 510 line of small and unmanned ground robots; iRobot PackBot 510 with EOD kit that adapts to various improvised explosive devices, conventional ordnance, and SWAT missions; and iRobot PackBot 510 with FasTac kit to investigate suspicious objects, as well as to identify roadside bombs and IEDs. The company also provides its PackBot products in various configurations, including iRobot PackBot EOD to conduct explosive ordnance disposal, hazardous materials, search-and-surveillance, and law enforcement tasks; and iRobot PackBot with ICx fido explosives detection kit to screen packages and dangerous items. iRobot Corporation sells its products through chain stores and national retailers, as well as through the Internet to consumers, the U.S. military, and other government agencies. It has strategic alliances with The Boeing Company; Advanced Scientific Concepts, Inc.; and TASER International, Inc. The company was formerly known as IS Robotics Corporation and changed its name to iRobot Corporation in December 2000. iRobot Corporation was founded in 1990 and is headquartered in Bedford, Massachusetts with additional offices in Durham, North Carolina; and San Luis Obispo, California.

The Gabelli Global Gold, Natural Resources and Income Trust (AMEX: GGN) is a closed ended equity mutual fund launched by GAMCO Investors, Inc. The fund is managed by Gabelli Funds, LLC. It invests in the public equity markets across the globe. The fund makes investment in equity securities of firms operating in gold and natural resources industries including companies in exploration, mining, fabrication, processing, distribution or trading of gold, financing, managing, controlling or operating of companies engaged in gold-related activities. It also invests in companies principally engaged in the exploration, production or distribution of natural resources, such as gas, oil, paper, food and agriculture, forestry products, metals and minerals as well as related transportation companies and equipment manufacturers. The fund employs a fundamental analysis focusing on factors such as asset quality, balance sheet leverage, management ability, reserve life, cash flow, and commodity hedging exposure for selecting individual securities. It also seeks to earn income through an option strategy of writing covered call options on equity securities in its portfolio. The fund benchmarks the performance of its portfolio against the CBOE S&P 500 Buy/Write Index, Philadelphia Gold & Silver Index, Amex Energy Select Sector Index, and the Lehman Brothers Government/Corporate Bond Index. The Gabelli Global Gold, Natural Resources and Income Trust was formed on January 4, 2005 and is domiciled in United States.

Novogen Limited (NASDAQ: NVGN) and its subsidiaries engage in the research and development of pharmaceutical products, and marketing of consumer healthcare products. Its consumer healthcare products comprise Promensil, a range of natural products specifically for womena�s health; Trinovin, a natural product specifically for mena�s midlife health; and Vinalac, a probiotic formula to help prevent childhood allergies, such as eczema in children at risk of an allergy. The company is developing various pharmaceutical products, including Phenoxodiol, a phase III investigational drug for late stage, chemoresistant ovarian cancer and prostate, and cervical cancers; Triphendiol, a phase I signal transduction inhibitor for the treatment of cholangiocarcinoma or bile duct cancer, and stage IIB through stage IV malignant melanoma; NV-128, a pre-clinical stage cancer compound to promote cancer cell death in multia"drug resistant ovarian cancer cells by targeting the AKT-mTOR pathway; anti-inflammatory product NV-52, a phase Ib drug for the treatment of inflammatory bowel disease; and FAIMs, flavonoid anti-inflammatory molecules to avoid cardiovascular, gastrointestinal, and renal side effects associated with anti-inflammatory drugs. It is also developing NV-27, a phase I drug to reduce restenosis or reblocking of arteries after surgery to clear blockages, commonly involving insertion of arterial stents; and GLYC-101, a phase IIa product for the treatment of burn wounds. Novogen Limited offers its products in Australia, North America, and Europe. The company was founded in 1994 and is headquartered in North Ryde, Australia.

The Medicines Company (NASDAQ: MDCO), a pharmaceutical company, provides medicines for the treatment of critical care patients worldwide. It markets Angiomax, an intravenous direct thrombin inhibitor for use as an anticoagulant in combination with aspirin in patients with unstable angina undergoing percutaneous transluminal coronary angioplasty; and Cleviprex, a dihydropyridine calcium channel blocker, for the control of high blood pressure. The companya�s development products include cangrelor, an injectable antiplatelet agent that prevents platelet activation and aggregation in the clotting process; Oritavancin, a semi-synthetic lipoglycopeptide antibiotic for the treatment of gram-positive infections; and CU-2010 for the prevention of blood loss during surgery. Its customers include hospital management, physicians, hospital pharmacists, nurses, and other care staff. The Medicines Company sells its products through sales representatives and managers. The company has commercial supply agreement with Lonza Braine S.A. for the development and supply of the Angiomax bulk drug substance. The Medicines Company was founded in 1996 and is based in Parsippany, New Jersey.

Saks Incorporated (NYSE: SKS), together with its subsidiaries, operates fashion retail stores in the United States. It operates stores under Saks Fifth Avenue (SFA) and Saks Fifth Avenue OFF 5TH (OFF 5th) brand names. The companya�s stores offer a range of luxury fashion apparel, shoes, accessories, jewelry, cosmetics, and gifts. SFA stores are principally free-standing stores in shopping destinations or anchor stores in upscale regional malls. OFF 5th stores are primarily located in upscale mixed-use and off-price centers. As of January 31, 2009, Saks operated 53 SFA stores and 51 OFF 5th stores. The company also sells its products through catalogs or Internet at saks.com. Saks Incorporated has a credit card strategic alliance with HSBC Bank Nevada. The company was founded in 1919 and is headquartered in New York, New York.

Rubicon Minerals Corporation (AMEX: RBY), a gold exploration company, engages in the acquisition, exploration, and development of gold resource properties in Canada and the United States. It principally owns a 100% interest in the Phoenix Gold project located in the heart of the prolific Red Lake gold district of Ontario. The company was founded in 1996 and is headquartered in Vancouver, Canada.

About BUYINS.NET

WWW.BUYINS.NET is a service designed to help bonafide shareholders of publicly traded US companies fight naked short selling. Naked short selling is the illegal act of short selling a stock when no affirmative determination has been made to locate shares of the stock to hypothecate in connection with the short sale. Buyins.net has built a proprietary database that uses Threshold list feeds from NASDAQ, AMEX and NYSE to generate detailed and useful information to combat the naked short selling problem. For the first time, actual trade by trade data is available to the public that shows the attempted size, actual size, price and average value of short sales in stocks that have been shorted and naked shorted. This information is valuable in determining the precise point at which short sellers go out-of-the-money and start losing on their short and naked short trades.

BUYINS.NET has built a massive database that collects, analyzes and publishes a proprietary SqueezeTrigger for each stock that has been shorted. The SqueezeTrigger database of nearly 2,550,000,000 short sale transactions goes back to January 1, 2005 and calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like Buyins.net to access the data.

The SqueezeTrigger database collects individual short trade data on over 7,000 NYSE, AMEX and NASDAQ stocks and general short trade data on nearly 8,000 OTCBB and PINKSHEET stocks. Each month the database grows by approximately 50,000,000 short sale transactions and provides investors with the knowledge necessary to time when to buy and sell stocks with outstanding short positions. By tracking the size and price of each montha�s short transactions, BUYINS.NET provides institutions, traders, analysts, journalists and individual investors the exact price point where short sellers start losing money and a short squeeze can begin.

All material herein was prepared by BUYINS.NET, based upon information believed to be reliable. The information contained herein is not guaranteed by BUYINS.NET to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. None of the companies in this report have paid to be included in this report. From time to time we will mention a company that may have previously paid $995 per month for market data purchased from BUYINS.NET. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. BUYINS.NET is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. BUYINS.NET will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

BUYINS.NET, FRICTION FACTOR and SQUEEZETRIGGER are intended for use by stock market professionals. As a member, visitor, or user of any kind, you accept full responsibilities for your investment and trading actions. The contents of BUYINS.NET, including but not limited to all implied or expressed views, opinions, teachings, data, graphs, opinions, or otherwise are not predictions, warranty, or endorsements of any kind. Please seek stock market advice from the proper securities professional, or investment advisor.

By visiting BUYINS.NET or using any data or services, you agree to assume full responsibility for the decisions or actions that you undertake. BUYINS.NET, LLC, its owner(s), operators, employees, partners, affiliates, advertisers, information providers and any other associated person or entity, shall under no circumstances be held liable to the user and/or any third party for loss or damages of any kind, including but not limited to trading losses, lost trading opportunity, direct, indirect, consequential, special, incidental, or punitive damages. As a user, you agree that any damages collected shall not exceed the amount paid to BUYINS.NET and/or its owners. As a website user, you agree that any and all legal matters of any kind are to be reviewed and handled in their entirety within the State of California only. By using the services of this website, you are consenting to the terms as outlined, and forfeit all legal jurisdictions in any other State. Past performance is not a guarantee of future outcomes. Any and all examples are hypothetical and should not be considered a guarantee or endorsement of such trading activity. BUYINS.NET does not take responsibility for problems of any kind, including but not limited to issues with operations, data accuracy or completeness, contacting issues, technical issues, and timeliness. BUYINS.NET places great integrity on the data collected and distributed. This information is deemed reliable, but not guaranteed. All information and data is provided "as is" without warranty or guarantee of any kind.

Please seek investment and/or trading advice, council, information or services from a securities professional. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and BUYINS.NET undertakes no obligation to update such statements.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the SEC.

Contact: Thomas Ronk, CEO www.BUYINS.net +1-800-715-9999 Tom@buyins.net