What A Weakening Economy Means For Visa (NYSE:V)

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

What a Weakening Economy Means for Visa: A Macro‑Perspective on the Payments Giant’s Growth Outlook

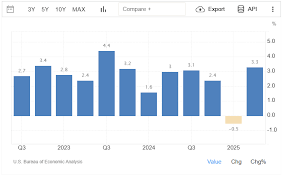

In an era of high inflation, tightening monetary policy, and slowing global growth, the payments industry—long considered a defensive sector—faces new headwinds. Seeking Alpha’s recent analysis of Visa’s financial health and strategic positioning lays out how the company’s revenue and profitability could be strained by a softer economy. By weaving together data from Visa’s latest earnings, macro‑economic trends, and industry dynamics, the piece offers a comprehensive view of what investors can expect in the coming quarters.

1. Visa’s Business Model in a Downturn

Visa operates as a neutral intermediary, earning fees from card issuers, acquirers, and merchants for processing transactions. Its revenue is largely driven by:

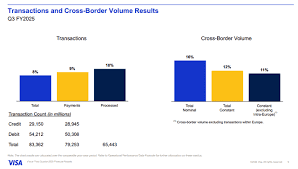

- Transaction Volume – The number of card‑swipes worldwide.

- Fee Structure – The percentage Visa charges on each transaction.

- Cross‑Border Usage – International card spending generates higher fees.

A weakening economy typically curtails consumer spending, both online and offline. This translates into fewer card‑swipes and lower transaction volumes, squeezing Visa’s fee‑based revenue. Moreover, as global trade slows, cross‑border spending—a premium revenue stream—tends to contract more sharply than domestic usage.

2. Macro‑Trends Driving the Risk

a. Rising Interest Rates and Inflation

The Federal Reserve’s policy tightening has pushed short‑term rates to 5.25‑5.50% (as of Q3 2024), and the European Central Bank follows a similar path. Higher rates increase the cost of borrowing, leading to reduced consumer credit‑card balances and slower credit growth. Visa’s own financial statements reveal a modest uptick in credit‑card delinquencies that aligns with the macro backdrop.

b. Weakening Consumer Confidence

Surveys show that consumer confidence indices in the United States and Europe have dipped below 95, signalling hesitation to spend on discretionary items. Visa’s transaction‑volume growth rates for the past two quarters—2.5% in Q2 and 1.8% in Q3—reflect this trend, falling short of the 4–5% growth seen in pre‑pandemic years.

c. Corporate Spending Contraction

Visa’s business‑to‑business (B2B) card usage—often associated with corporate travel and expense programs—has also been impacted. With corporate budgets tightening, companies are canceling or deferring travel, resulting in a 12% year‑over‑year decline in B2B transaction volumes.

3. Visa’s 2024 Outlook in Light of the Slowdown

Visa’s most recent quarterly guidance projects 2024 revenue growth of 6% to 8%, below the 9% growth forecasted in its Q3 2023 earnings call. The company cited “softening macro conditions” as a key reason for the downward revision. While Visa’s fee‑rate per transaction has remained steady, it is uncertain whether the same fee intensity can be preserved when the total number of swipes declines.

The article also points out that Visa’s balance‑sheet health remains robust: a strong liquidity cushion (cash & cash equivalents $16 bn) and low leverage (debt‑to‑EBITDA <0.5x). However, the author emphasizes that a prolonged slowdown could erode earnings per share (EPS) growth and pressure the company’s valuation multiples.

4. Competitive Dynamics

a. Digital Wallets and Neobanks

Visa’s biggest competitor, Mastercard, has been aggressively investing in digital wallet solutions (e.g., Mastercard PayPass, digital‑wallet partnerships). The article notes that in 2024, Mastercard is expected to achieve a 10% share of the “cash‑less” segment, surpassing Visa’s 8% market share. This shift could undermine Visa’s fee advantage if merchants gravitate toward wallet‑based payments with lower interchange fees.

b. FinTech Partnerships

Visa has been partnering with FinTechs (e.g., Stripe, Adyen) to capture merchant traffic that traditionally flowed through Visa’s core network. Nonetheless, the analysis suggests that such partnerships are largely revenue‑neutral or slightly negative in the short term, as they involve revenue sharing and reduced interchange margins.

5. Opportunities Amid Uncertainty

Despite the challenges, the article outlines several silver linings for Visa:

- Emerging Markets Growth – Visa still sees high‑growth potential in Asia‑Pacific and Sub‑Saharan Africa, where digital payments are expanding rapidly.

- Enterprise Solutions – Visa’s “Visa Direct” and “Visa B2B” platforms provide higher‑margin revenue streams that are less sensitive to consumer spending cycles.

- Regulatory Advantage – The company’s deep compliance infrastructure positions it well for a regulatory shift toward stricter data‑privacy and cross‑border payment transparency.

6. Bottom Line for Investors

The Seeking Alpha piece concludes that a weakening economy casts a tangible, though not catastrophic, shadow over Visa’s near‑term growth prospects. While the firm’s core business model remains resilient, investors should monitor:

- Transaction‑volume trends across domestic and cross‑border segments.

- Credit‑card delinquency rates that could erode fee income.

- Competitive pressure from digital wallets and FinTech ecosystems.

For those weighing a position in Visa, the article recommends a cautious stance: stay bullish on the long‑term structural demand for digital payments, but remain mindful of the macro‑environment’s capacity to compress growth and margins in the next 12–18 months.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4821459-what-weakening-economy-means-for-visa ]