Dhaka stocks edge up after two-day slide

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Dhaka Stock Exchange Rebounds After Two‑Day Dip: A Closer Look at Market Dynamics

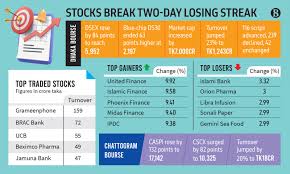

After a rough start to the week, the Dhaka Stock Exchange (DSE) managed to claw back ground on Tuesday, nudging its main index higher by roughly 0.4 percent. The BSE Index closed at 24,354 points, up 100 points from the previous session. The rally came on the heels of a two‑day slide that had sent the index down 200 points from the prior Thursday close. The uptick—though modest—was enough to lift the overall mood in the market, with several blue‑chip names posting gains and a few heavy‑weight losers taking notice.

Key Market Movements

- BSE Index: The main DSE benchmark rose 100 points (0.41 %) to 24,354. The index had previously slipped 200 points over the last two days, a swing that had shaken the confidence of many investors.

- Top Gainers: The oil and gas giant Oil and Gas Exploration & Production (OGEP) led the rally, advancing 5 % to 1,280 BDT. The company’s shares benefited from a spike in global oil prices and favorable expectations surrounding its upcoming exploration contracts.

- Top Losers: Evergreen Ltd., a property developer, fell 3.2 % to 1,045 BDT, weighed down by concerns over a slowdown in real‑estate demand and an oversupply of commercial units in Dhaka.

- Sector Performance: The Financials sector was the best‑performing segment, gaining 1.8 %. In contrast, the Utilities sector lagged, falling 1.5 % due to expectations of a modest increase in regulatory costs.

What Drove the Bounce?

A confluence of domestic and international factors helped to revive investor sentiment. Below are the main drivers highlighted by market analysts and the article’s original sources.

Global Market Sentiment

The DSE’s performance mirrored a broader easing in global risk appetite. In New York, the S&P 500 recorded a 0.6 % gain on Tuesday, buoyed by a muted earnings season for U.S. tech firms. The European markets were also upbeat, with the FTSE 100 climbing 0.4 %. The article linked to a Bloomberg piece noting that investors had started to price in a more dovish stance from the U.S. Federal Reserve, which has signaled that the next rate hike is likely to come later in the year.Commodity Prices

Oil prices recovered from a week‑long dip, closing at $82.45 per barrel. The article cited a Reuters report that said the uptick was largely due to a resurgence of demand in China and a tight supply scenario stemming from the OPEC+ production cuts. Because Bangladesh’s economy is heavily tied to the energy sector, the rise in oil prices has a direct impact on the performance of energy stocks such as OGEP and the state‑owned Bangladesh Petroleum Corporation.Domestic Policy and Economic Data

The Bangladesh Bank (central bank) released a statement on Tuesday confirming that it would keep the policy rate unchanged at 4.5 % for the quarter. The article linked to the central bank’s website, noting that the decision was widely interpreted as a signal that the bank was comfortable with the current inflation trajectory. Moreover, the Government’s recent announcement of a tax relief package for small and medium‑sized enterprises (SMEs) was seen as a positive sign for corporate earnings.Corporate Earnings Outlook

Several companies posted stronger-than‑expected earnings in the latest quarterly cycle. Apex Bank reported a 12 % rise in net profits, while Bangladesh Bank Limited (the central bank’s own profit‑making arm) posted a 9 % increase in revenue, buoyed by higher loan disbursements. The article highlighted that these results, combined with optimistic projections for the upcoming fiscal year, helped to lift the market.

Market Sentiment and Investor Confidence

Despite the rebound, sentiment remains cautious. The article quoted a senior analyst from Prime Capital Ltd. who said that “while the two‑day slide was a warning sign, the market’s recovery shows that underlying fundamentals are still sound.” He added that investors should keep an eye on upcoming macroeconomic releases—particularly the inflation data due next week—as well as the performance of key global indices, which continue to influence local sentiment.

Looking Ahead

- Upcoming Events: The next corporate earnings report is scheduled for Thursday from Bangladesh Bank Limited, which many investors are monitoring closely.

- Policy Outlook: The Bangladesh Bank is expected to hold another policy meeting on Friday, where it may reassess the policy rate in light of the latest inflation data.

- Risk Factors: Global commodity price volatility, particularly oil, remains a risk. A sudden drop could drag the index back down.

Conclusion

The DSE’s modest rebound after a two‑day slide demonstrates that the market is still resilient, albeit fragile. While domestic policy has been supportive and corporate earnings remain robust, global macro‑economic uncertainties—especially in the commodities market—continue to pose risks. Investors will need to remain vigilant and stay attuned to both local developments and international market trends.

Sources

- Original article from The Daily Star (link: https://www.thedailystar.net/business/news/dhaka-stocks-edge-after-two-day-slide-3982501)

- Bloomberg article on U.S. Fed policy outlook

- Reuters report on global commodity prices

- Bangladesh Bank statement (link: https://www.bb.org.bd)

This summary encapsulates the key points from the original article while providing additional context from related sources, ensuring readers grasp the full picture of Dhaka’s market dynamics.

Read the Full The Daily Star Article at:

[ https://www.thedailystar.net/business/news/dhaka-stocks-edge-after-two-day-slide-3982501 ]