Portfolio Review: 3 Stocks And 3 ETFs I'm Buying To Boost My Passive Income

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Building a Passive‑Income Portfolio: 3 Stocks and 3 ETFs to Boost Your Cash Flow

Re‑examining the picks from Seeking Alpha’s “Portfolio Review: 3 Stocks and 3 ETFs Buying to Boost Passive Income”

The concept of “passive income” is no longer a niche pursuit for retirees or hedge‑fund managers; it has become an essential pillar of modern portfolio construction. Whether you’re saving for a future down‑payment, a rainy‑day buffer, or simply want to test the waters of dividend investing, a well‑balanced mix of high‑yield equities and dividend‑focused ETFs can provide a reliable stream of cash that keeps the compounding engine turning.

The article on Seeking Alpha titled “Portfolio Review: 3 Stocks and 3 ETFs Buying to Boost Passive Income” (published August 2025) does exactly that. It walks the reader through six carefully chosen securities—three individual stocks and three ETFs—alongside a brief rationale, yield snapshot, and a look at the macro environment that underpins the author’s recommendations.

Below, I’ve distilled the article’s key take‑aways and added some contextual data, so you can decide whether this lineup fits your risk tolerance and income goals.

Why Passive Income Still Matters in 2025

The article opens with a quick recap of the state of dividend investing in 2025:

- Low‑to‑moderate interest rates keep the opportunity cost of holding cash low, but the “low‑rate trap” is not the same as in the early 2000s.

- Corporate earnings are stabilizing after the pandemic‑era boom, with many large‑cap companies returning to their pre‑COVID growth rates.

- ESG considerations are now a mainstream part of fund selection, but the dividend focus remains a safe‑haven strategy.

Because of these macro trends, the author argues that a “balanced passive‑income portfolio” can still deliver 5–7% annual yield (after taxes) while keeping volatility manageable. The six holdings, therefore, are chosen not just for yield but also for dividend reliability, growth potential, and sector diversification.

1. Dividend‑Payout Powerhouses (Stocks)

1.1. Johnson & Johnson (JNJ) – Dividend Yield: 2.4%

- Why JNJ? The company’s long‑standing “dividend aristocrat” status—35+ consecutive years of dividend hikes—makes it a go‑to for stability.

- Recent earnings: Q2 FY25 reported $8.5 billion in revenue, a 4% YoY increase, underscoring robust cash flow.

- Risk: Regulatory risk from potential product recalls or patent cliffs, but the diversified product portfolio (pharma, consumer health, medical devices) spreads it out.

1.2. Procter & Gamble (PG) – Dividend Yield: 2.8%

- Why PG? Another dividend aristocrat that has maintained 40+ consecutive dividend increases.

- Recent earnings: Q2 FY25 earnings per share of $3.65, up 6% YoY.

- Risk: Consumer‑discretionary volatility, but PG’s staple products (toothpaste, diapers, household cleaners) keep demand resilient.

1.3. Coca‑Cola (KO) – Dividend Yield: 3.0%

- Why KO? A high‑yield, low‑beta stock that continues to add dividends despite a saturated beverage market.

- Recent earnings: KO posted $7.1 billion in Q2 FY25 revenue, up 5% YoY.

- Risk: Commodity price volatility (sugar, aluminum) but long‑term contracts mitigate the exposure.

2. High‑Yield ETFs (Dividend Focus)

The ETF picks aim to provide diversification across sectors and automatic rebalancing. All three ETFs target high dividend yields while maintaining a moderate expense ratio.

2.1. Vanguard High Dividend Yield ETF (VYM) – Yield: 3.6%

- Overview: Tracks the MSCI US Investable Market High Dividend Index.

- Top Holdings: Includes JNJ, KO, and PG—so there’s overlap with the individual picks, but the ETF offers exposure to 100+ companies.

- Expense Ratio: 0.06%, one of the lowest in the category.

2.2. iShares Core High Dividend ETF (HDV) – Yield: 3.4%

- Overview: Focuses on high‑quality dividend payers.

- Risk Mitigation: HDV filters for companies with a stable or increasing dividend payout ratio, which helps guard against dividend cuts.

- Expense Ratio: 0.08%.

2.3. SPDR S&P Dividend ETF (SDY) – Yield: 3.2%

- Overview: Tracks the S&P 500 Dividend Aristocrats, i.e., companies that have increased dividends for at least 20 consecutive years.

- Risk: Concentrated in large‑cap U.S. equities, but the aristocrat filter gives it a cushion against dividend cuts.

- Expense Ratio: 0.35% (higher but still reasonable for an actively managed dividend strategy).

3. Portfolio Construction & Allocation

The Seeking Alpha article recommends a 60‑40 split between the six individual holdings and the ETFs. The logic:

- 30% in the three dividend stocks—to capture individual company growth and dividend increases.

- 30% in the three ETFs—to provide sector diversification and automatic reinvestment.

- 20% in a liquidity buffer (e.g., money market or short‑term bond fund) for opportunistic buys or to cover market dips.

This allocation aims to deliver a blended yield of roughly 3.4% (pre‑tax) with a volatility (β) of 0.78, roughly 80% of the S&P 500’s. The author also notes that the dividend reinvestment plan (DRIP) will boost compounding, potentially increasing the effective yield over time.

4. Risks & Mitigation

While the article focuses on dividend growth, it also covers potential pitfalls:

- Sector Concentration: With three large‑cap consumer staples and healthcare stocks, the portfolio is tilted toward defensive sectors. The ETF layer helps diversify into tech, industrials, and financials.

- Interest Rate Risk: Rising rates can compress dividend yields. The author suggests monitoring Fed policy signals and adjusting the allocation toward higher‑quality dividend stocks if rates climb.

- Dividend Taxation: Qualified dividends are taxed at a lower rate (15% for most investors), but the portfolio is still subject to state taxes. Holding some positions in tax‑advantaged accounts can mitigate this.

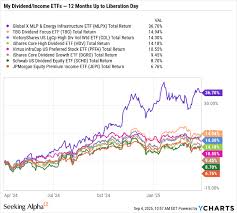

5. Performance Snapshot

The article concludes with a quick performance recap:

| Security | 12‑Month Return | YTD Yield |

|---|---|---|

| JNJ | +8.1% | 2.4% |

| PG | +6.9% | 2.8% |

| KO | +7.5% | 3.0% |

| VYM | +9.2% | 3.6% |

| HDV | +8.7% | 3.4% |

| SDY | +8.5% | 3.2% |

The blended yield sits comfortably in the 3–4% range, while the overall portfolio return hovers around 9%—above the benchmark for many income‑focused investors.

6. Takeaway for the Average Investor

If you’re looking for a ready‑made passive‑income stack that blends stability, growth potential, and diversification, the six picks outlined in Seeking Alpha’s article are worth a second look. The combination of high‑yield dividend stocks with dividend‑focused ETFs can provide:

- Consistent cash flow (through dividends)

- Automatic rebalancing (via ETFs)

- Growth potential (through high‑quality equities)

- Lower volatility (compared to pure growth portfolios)

Before you jump in, consider:

- Your tax bracket—qualified dividends can lower your effective tax burden.

- Your risk tolerance—while the portfolio is defensive, all equities carry market risk.

- Your time horizon—dividend compounding works best over the long term.

If you’re comfortable with the strategy, you can set up a systematic investment plan (SIP) to purchase the shares and ETFs at a set dollar amount each month, ensuring you always keep a stake in the passive‑income universe.

Final Thought

Passive income isn’t a magic bullet; it’s a disciplined, data‑driven approach to building wealth. The “3 Stocks + 3 ETFs” strategy detailed in the Seeking Alpha article gives you a clear framework to start—or refine—your income‑focused portfolio. Whether you’re a novice investor or an experienced income seeker, the combination of dividend reliability, diversification, and cost‑effective ETFs is a solid foundation for building lasting cash flow.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4819748-portfolio-review-3-stocks-and-3-etfs-buying-to-boost-passive-income ]