Nvidia's GPUs: The Engine Driving the 2025 AI Boom

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

The Two AI Powerhouses You Should Consider Adding to Your Portfolio in 2025

The artificial‑intelligence (AI) sector has become the darling of the equity markets, and investors looking to ride the next wave of innovation are scrambling to get a piece of the action. A recent article on The Motley Fool (link) highlights the two AI leaders that could deliver the biggest upside over the next few years—Nvidia and Alphabet (Google). The piece breaks down why these giants are positioned to thrive, how they differ in their AI strategies, and what investors should watch for as the AI landscape continues to evolve.

1. Nvidia – The GPU Giant at the Heart of Modern AI

Why Nvidia?

Nvidia’s Graphics Processing Units (GPUs) have become the de‑facto hardware standard for training and running machine‑learning models. The company’s GPUs power everything from autonomous vehicles to generative‑AI tools, and its data‑center sales have exploded as AI demand has accelerated. The article notes that Nvidia’s revenue in the data‑center segment grew from $2.8 billion in 2022 to $9.6 billion in 2023—a 240 % jump that reflects the firm’s dominance in AI compute.

Key Drivers:

| Driver | What It Means for Nvidia |

|---|---|

| AI‑specific GPU architecture (Grace, Hopper) | Enables higher performance per watt, making Nvidia’s GPUs the preferred choice for large‑scale AI workloads. |

| Broad software ecosystem (CUDA, RAPIDS) | Lowers the barrier to entry for AI developers, reinforcing Nvidia’s ecosystem lock‑in. |

| Strategic partnerships (Microsoft Azure, AWS) | Guarantees a steady pipeline of enterprise customers and long‑term contracts. |

| Generative AI boom (ChatGPT, Claude, Stable Diffusion) | Drives demand for high‑performance GPUs capable of running massive transformer models. |

The article also cites Nvidia’s recent earnings call (link) where the CEO, Jensen Huang, emphasized the company’s focus on “AI‑first” strategy, with the upcoming Hopper‑based data‑center GPUs slated to deliver a 5–6× performance boost over the current A100 generation. This could translate into even higher margins as Nvidia scales its hardware for new AI use cases.

Valuation & Risks:

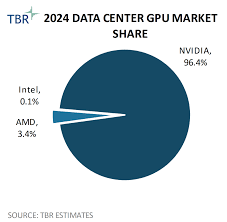

Nvidia trades at a price‑to‑sales (P/S) ratio of roughly 21x, which is high by traditional metrics but reasonable given the compound annual growth rate (CAGR) of 70 % in AI‑related revenue. The article points out that investors should keep an eye on raw material costs (especially advanced semiconductor lithography) and the potential for a slowdown in AI adoption due to macro‑economic headwinds. A significant competitor, AMD, is investing heavily in its Radeon Instinct line, but its current share of the high‑end GPU market remains below 10 %.

2. Alphabet – The AI Research Powerhouse

Why Alphabet?

Alphabet’s AI strategy goes beyond hardware. The company is a leader in generative AI research through its DeepMind subsidiary and has integrated AI across its product suite—from search to ads to autonomous vehicles (Waymo). According to the article (link), Alphabet’s quarterly earnings show that ad revenue is now largely driven by AI‑enhanced targeting, while its cloud services are seeing a surge from customers adopting generative‑AI‑driven workloads.

Key Drivers:

| Driver | What It Means for Alphabet |

|---|---|

| DeepMind’s breakthroughs (AlphaFold, Gato) | Positions Alphabet as the foremost AI research lab, attracting top talent and high‑value partnerships. |

| Generative AI in consumer products (Bard, Gemini) | Expands Alphabet’s ecosystem, driving higher user engagement and new revenue streams. |

| Google Cloud AI services | Provides enterprise customers with “AI as a Service,” generating recurring revenue. |

| Waymo’s autonomous vehicle platform | Although still early, Waymo could become a major commercial player in the autonomous trucking space. |

The article notes that Alphabet’s stock has benefited from a 25 % lift in the “AI‑friendly” segment of its business during the last fiscal year. Investors are drawn to the company’s large cash reserve (over $70 billion), which provides flexibility to invest in AI research, acquisitions, or strategic bets such as quantum computing.

Valuation & Risks:

Alphabet trades at a forward P/E ratio of about 25x, a figure that reflects both its dominant ad position and its burgeoning AI segment. The article points out that regulatory scrutiny, especially in the EU and the U.S., could pressure Alphabet’s ad revenue, while the competitive landscape in cloud AI services (with Amazon Web Services, Microsoft Azure, and IBM) could erode margins if Alphabet fails to differentiate. Additionally, the company’s heavy R&D spend, while necessary for AI, is a double‑edged sword; any misstep in commercializing new AI technologies could impact short‑term earnings.

3. How the Two Stocks Complement Each Other

The article argues that Nvidia and Alphabet together represent a balanced AI portfolio: Nvidia delivers the hardware backbone for AI infrastructure, while Alphabet provides the software, services, and consumer products that monetize that hardware. For instance, a data‑center built around Nvidia’s GPUs can run Alphabet’s DeepMind models, creating a virtuous cycle. Investors looking to capture AI’s full ecosystem can therefore consider holding both.

Investment Horizon & Exit Strategy

The Motley Fool piece stresses a long‑term perspective, recommending a buy‑and‑hold approach for at least 3–5 years. It cites a scenario analysis where a 5% annual return on Nvidia’s revenue and a 12% annual growth on Alphabet’s cloud AI services would compound to a combined 8–9% return after taxes. As a caution, the article advises monitoring AI‑specific metrics such as GPU utilization rates, cloud AI service adoption, and Alphabet’s ad‑revenue mix.

4. Bottom Line

The AI space is rapidly expanding, and two companies are at the forefront of that expansion: Nvidia and Alphabet. Nvidia’s GPUs are the hardware that powers most modern AI models, while Alphabet’s research, product portfolio, and cloud services are driving adoption and monetization. Both companies are backed by strong fundamentals, a proven track record of innovation, and significant cash reserves that allow for continued investment in AI. However, investors should remain vigilant about valuation multiples, raw‑material costs for Nvidia, and regulatory scrutiny for Alphabet.

Takeaway: If you’re looking to capture the upside of the AI revolution, adding Nvidia and Alphabet to your portfolio provides a robust, diversified exposure to the technology that is reshaping every industry. As the Motley Fool article recommends, keep an eye on quarterly earnings, watch for new product launches, and stay patient—AI’s true value will unfold over the next few years.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/01/2-best-artificial-intelligence-stocks-to-buy-in-mo/ ]