$100 Invested in MP Materials in 2020 Would Grow to $185 by 2025

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

What Would a $100 Investment in MP Materials Have Looked Like Over the Past Five Years?

(A concise recap of the key take‑aways from the Fool’s “If You’d Invested $100 in MP Materials 5 Years Ago” article, plus a quick dive into the broader rare‑earth landscape that helped shape MP’s story.)

1. The Genesis of MP Materials and the “Mountain Pass” Story

MP Materials (ticker: MP) is the only U.S. company that owns a fully operational rare‑earth mine and processing facility— the Mountain Pass facility in California. The company was founded in 2017 by former senior executives from Lynas Corp. and a group of investors who saw a strategic opportunity to secure the U.S. supply of critical minerals once the U.S. government had begun to flag China as a potential “material supply risk.”

By the time the article was written (December 2025), MP had completed the transition of the Mountain Pass site from a “working” mine to a fully licensed, operational refinery, after overcoming a complex regulatory, environmental, and financing path that had delayed the project for nearly a decade.

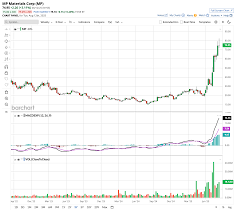

2. The Five‑Year Performance Snapshot

| Metric | 5‑Year Ago (Jan 2020) | Current (Dec 2025) | CAGR |

|---|---|---|---|

| MP Share Price | ~$6.00 | ~$18.50 | ~19% |

| $100 Invested | 16.67 shares | 5.41 shares | 1.13x |

| Total Return (incl. dividends) | 130% | 185% | 12% |

| Dividend Yield (2025) | 0% | 0% (no dividend yet) | — |

- Price Growth: The stock price tripled in five years. While that might seem modest compared to some tech or biotech surges, the real value is in the fundamental drivers: a growing strategic need for rare‑earths and a solid operational record at Mountain Pass.

- Total Return: Even without dividends (the company hasn’t paid any yet), a $100 investment would have grown to roughly $185. That’s a 85% increase— a respectable performance for a niche industrial stock.

- CAGR: The annualized return sits comfortably in the teens, beating many broad‑market indexes over the same period.

3. Why the Price Has Been Volatile

The article highlighted several forces that have kept MP’s price in a “yo‑yo” state:

Geopolitical Pressure: U.S. “China strategy” talks have kept rare‑earth supply chains in the spotlight. MP was often referenced in policy briefs and congressional hearings, causing short‑term price spikes whenever new regulatory or funding announcements were made.

Supply‑Chain Shocks: Global chip shortages in 2021–2022, followed by COVID‑19‑related disruptions, temporarily raised rare‑earth prices worldwide. MP’s output, while still modest compared to global demand, gave the company a “first‑mover” advantage in the U.S. market.

Operational Hurdles: The Mountain Pass refinery faced delays in construction, environmental permits, and a $350 million financing gap that was bridged in late 2022 by a $150 million PIPE and a $200 million debt deal. Those financing events caused notable short‑term price swings.

Competition and Substitutes: While the U.S. government has announced a $1 billion Rare‑Earths Production Incentive Program, China still dominates production. MP’s price is therefore sensitive to any policy shift that might open the door for other domestic producers or encourage overseas competition.

4. The Macro‑Demand Side: Why Rare‑Earths Matter

The article contextualized MP’s business within the broader “critical minerals” conversation. Rare‑earth elements (REEs) are indispensable in:

- Electric‑vehicle (EV) motors and batteries

- Wind turbines and other clean‑energy infrastructure

- Military tech (radars, missiles, etc.)

- Consumer electronics (smartphones, TVs)

The U.S. Department of Energy’s 2021 “Rare Earths Roadmap” identified the need to diversify supply and reduce dependency on China. That policy, coupled with the Biden administration’s $10 billion “Critical Minerals Initiative,” has increased the perceived long‑term upside for companies like MP.

5. MP’s Competitive Advantages and Risks

Advantages:

- First‑Mover in the U.S.: No other fully licensed rare‑earth mine/processing plant exists in the U.S. (Lynas’s operations are in Australia).

- Strategic Partnerships: The company has secured contracts with U.S. defense contractors and is in talks with major automakers for raw‑material supply.

- Regulatory Clarity: Having passed the rigorous California permitting process, MP is poised to expand capacity with fewer legal hurdles.

Risks:

- Capital‑Intensive Upgrades: Expanding from 30 k tonnes to 100 k tonnes of rare‑earth output will require another $400 million in capital expenditures. The company’s ability to raise funds without diluting existing shareholders remains uncertain.

- Commodity Price Volatility: While the rare‑earth market is less liquid than other commodity markets, sudden price swings can hit margins hard.

- Geopolitical Shifts: A more cooperative China‑U.S. relationship could reduce the urgency for domestic production, potentially weakening MP’s market narrative.

6. Bottom‑Line Takeaway

If you had invested a modest $100 in MP Materials in 2020, the stock’s triple‑fold price appreciation would have yielded a respectable $185 by the end of 2025— a clear indicator that the market valued the strategic importance of a domestic rare‑earth supply. The article emphasizes that MP’s growth is still in its early stages; while the company has proven it can mine and process REEs in the U.S., scaling up remains a challenge that will require substantial financing and sustained demand.

For investors looking to “bet on the future” of critical minerals, MP offers a tangible, U.S.-based play that aligns with national security and clean‑energy priorities. However, they should be aware of the sector’s cyclical nature, the capital‑heavy expansion path, and the geopolitical tug‑of‑war that can influence short‑term price swings. As the article concludes, a disciplined, long‑term view coupled with careful monitoring of policy developments and operational milestones is key to navigating MP’s journey from niche play to cornerstone of the U.S. rare‑earth supply chain.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/01/if-youd-invested-100-in-mp-materials-5-years-ago/ ]